Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

Big quote: The US launch of “World” highlights the potential of digital ID technology in an era of growing AI-driven fraud. Co-founder Sam Altman describes World’s technology as “a way to make sure humans remained central and special in a world where the internet had a lot of AI-driven content.” The company’s expansion comes amid ongoing scrutiny over its commitment to privacy, regulation, and public trust.

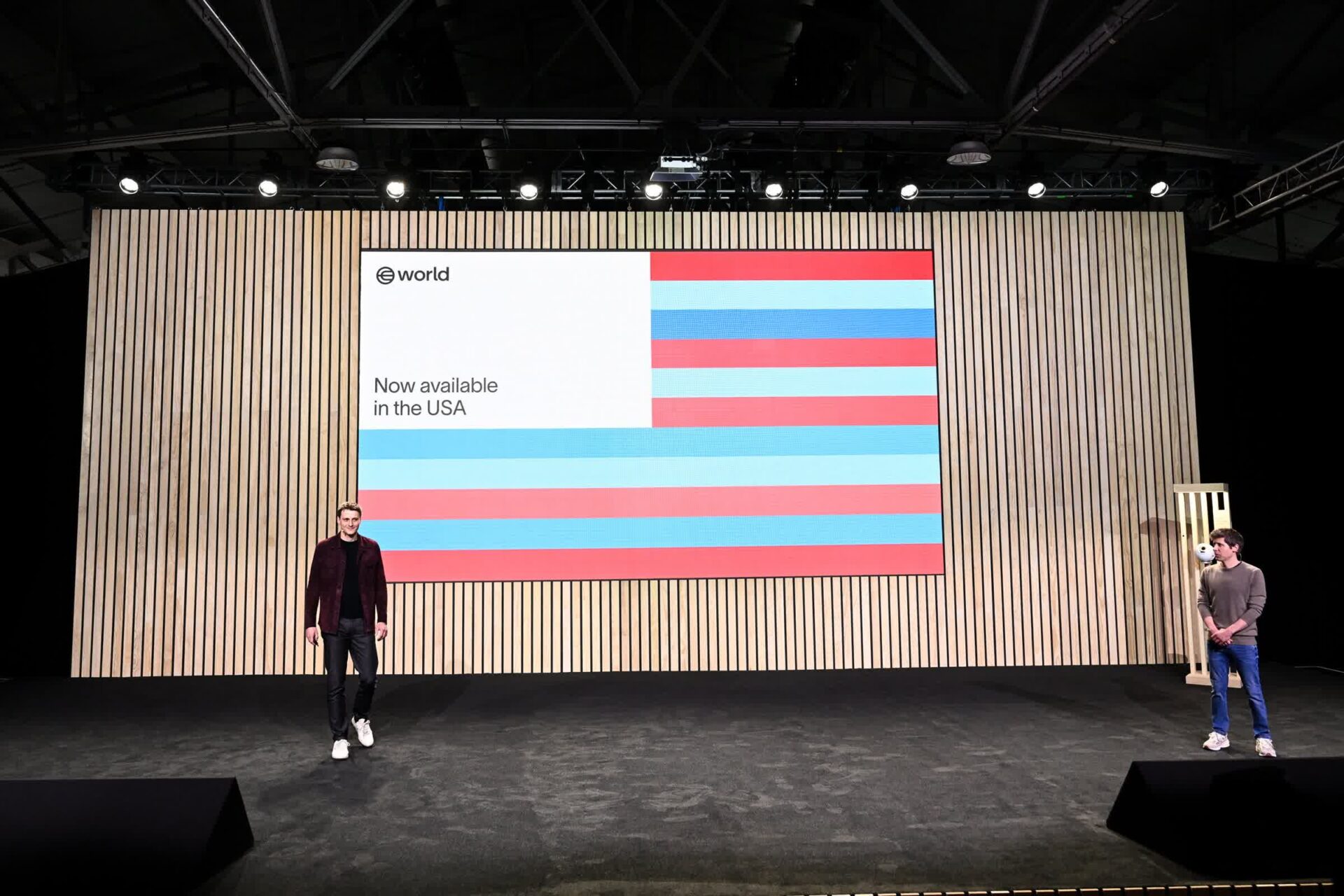

Sam Altman’s digital identity startup, World, has launched its iris-scanning technology and cryptocurrency token in the United States, aiming to make the country its core market after a global rollout that began in 2023.

This expansion comes as the Trump administration signals its support for digital assets, with the president pledging to make the US the “crypto capital of the planet.”

At the heart of World’s technology is the Orb, a metallic, spherical device designed to scan users’ irises and generate unique digital IDs stored on the blockchain. The Orb is positioned as a defense against the rising threat of deepfakes and online impersonation – a problem Altman sees as urgent in an era where GenAI blurs the line between real people and automated bots.

According to the company, the Orb’s biometric ID system allows users to prove their humanity without revealing personal information. World’s technology is debuting in six US cities: Atlanta, Austin, Los Angeles, Miami, Nashville, and San Francisco – with plans to deploy as many as 7,500 Orbs in the US over the next year, assembled at a new facility in Richardson, Texas.

The company is also introducing a portable “Orb mini” device, expected to ship in 2026, to further expand access to its identity verification system.

The Orb’s launch seems timely, as more sophisticated AI models are making online scams, phishing, and digital fraud more prevalent. World is already piloting its technology with Match Group in Japan to verify users on dating apps like Tinder to boost trust.

Adrian Ludwig, chief architect at Tools for Humanity – the company behind World – said the technology could also play a role in government, community services, and social networks, enhancing trust and safety across digital platforms.

World claims its user base has nearly doubled to 26 million in the past six months, but now the company faces significant regulatory scrutiny. Privacy concerns have led to bans, investigations, or fines in countries such as Spain, Portugal, Hong Kong, South Korea, and France. Spain’s data protection regulator, for example, blocked the service over concerns about collecting minors’ data.

Ludwig maintains that “all biometric data was anonymous,” and projected that “in 18 months or so we will begin to see the costs of operating the network begin to be offset by the fees that are generated by the network.”

The company’s app is being updated to support more financial transactions, including stablecoins, and World has partnered with Stripe to enable payments on supported websites. At the San Francisco event, the company also announced a proposed Visa-backed debit card, which would allow users to spend their World currency at any location accepting Visa and potentially earn rewards on AI subscriptions like ChatGPT Plus.

World’s ambition is to become a “super app” for identity and payments, a vision shared by other tech leaders. The app now offers access to third-party “mini apps,” including games and prediction markets, and continues to target global financial inclusion.

However, the company’s approach – particularly its collection and use of biometric data – remains controversial. In its early days, World marketed itself to unbanked populations, offering free crypto in exchange for iris scans, a practice that drew criticism from privacy advocates and regulators.

While World’s technology is now available in the United States, it is inaccessible to residents or organizations in New York or other unspecified restricted territories. The company has not explained this exclusion, and New York’s Department of Financial Services has not commented on the matter.